Motorbike Finance

Get a quote Find me a van

Rates from 9.9% APR.

Representative APR of 21.9% APR

APR Example

Representative example: borrowing £7,000 over 5 years with a representative APR of 21.9%, the annual interest rate of 21.9% (Fixed) and a deposit of £0.00, the monthly would be £178.52, with a total cost of credit of £3711.20 and a total amount payable of £10,711.20. Rates may differ as they are dependent on individual circumstances'. Rates from 9.9% APR: the exact rate you will be offered will be based on your circumstances, subject to status. Quick Car Finance are a broker not a lender.

Finding you the best rates on motorbike finance

- No deposit options

- No obligation quote

- No arrangement fees

- Most credit scores considered

How it works

- Complete Apply Form Tell us a little about what your looking for and who you are.

- Length of term How long are you looking to take finance out for?

- List of comparisons We will provide you with a list of competitive rates that suit your personal needs.

- Shop our best deals We will help you shop around to find the best deal that is available to you.

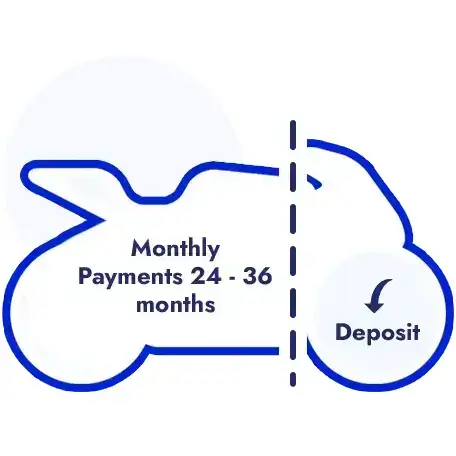

Motorbike Hire Purchase (HP)

Motorbike Personal Loan

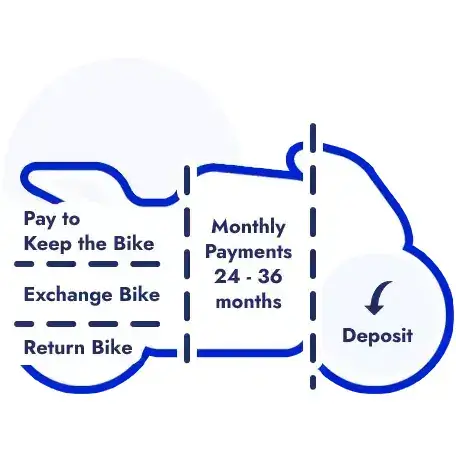

Personal Contract Purchase (PCP)

Am I eligible for motorbike finance?

We can look to find finance for people with a range of circumstances and you’ll have a dedicated account manager on hand to help you through the process.

- Age Am I 18 years or older?

- Residency Have I lived in the UK for more than 12 months?

- Income Do I earn an income of £1000 or more per month?

Take it directly from the people who know!

Fantastic help and assistance from Jack Sherwin. QCF were professional throughout and made the process of buying a new vehicle uncomplicated. From the initial call, to finding a car and eceiving the funds was arranged in a matter of a few days. Can’t speak highly enough about the company.

Motorbike Finance Finance FAQs

- Can I get a motorbike on finance with bad credit?

-

Yes, it is possible to get a motorbike on finance with bad credit, but it may be more challenging. Some specialized lenders and motorbike finance companies offer options for individuals with less-than-ideal credit histories. However, it's important to be aware that individuals with bad credit may face higher interest rates and more stringent loan terms compared to those with better credit. Additionally, the availability of options and the terms offered may vary depending on the severity of the credit issues.

- What credit score do you need to finance a motorbike?

-

The specific credit score required to finance a motorbike can vary depending on the lender and their specific criteria. Generally, a higher credit score improves your chances of qualifying for motorbike finance and may lead to more favorable loan terms, such as lower interest rates. While some lenders may consider applicants with lower credit scores, individuals with higher scores (typically 660 and above) are more likely to qualify for competitive financing options.

- Can I get finance for a motorbike?

-

Yes, you can obtain finance for a motorbike. Many lenders, including banks, credit unions, and specialized motorbike finance companies, offer financing options for purchasing a motorbike. Just like with car finance, motorbike finance allows you to spread the cost of the purchase over a set period, making it more affordable in the short term. Keep in mind that the availability and terms of motorbike finance can vary depending on factors like your creditworthiness, the type of motorbike, and the lender's policies.